German Pension Refund for Indian Nationals

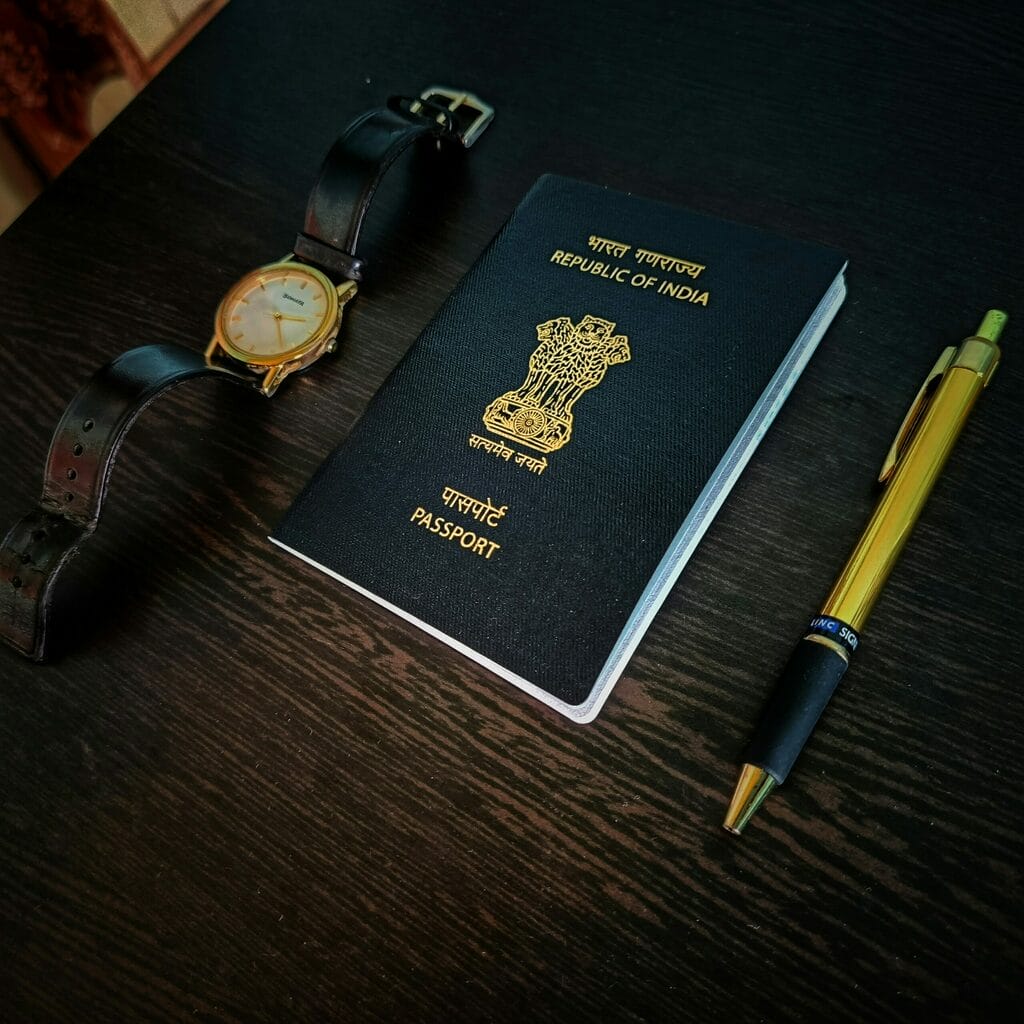

As an Indian citizen who has worked in Germany, getting to grips with the eligibility criteria for a pension refund is crucial. Your contributions to the German pension scheme during your employment are an important part of Germany’s social security system. Yet, the task of applying for a refund of these contributions and understanding the specific requirements for Indian nationals can seem overwhelming.

This article offers a deep dive into the key information regarding eligibility for a German pension refund for Indian citizens.

Whether you’re thinking about applying for a German pension refund or want to learn more about the social security agreements between Germany and India, this guide is designed to provide clear insights and advice to help you make well-informed choices about your financial future once you leave Germany.

German Pension Refund Eligibility for Indian Citizens

Living and working in Germany as an Indian citizen means that about 9% of your monthly taxable earnings go directly into the Deutsche Rentenversicherung, which is Germany’s official pension insurance system. It’s important to remember that this financial burden isn’t yours alone to bear, as your employer also contributes to your social security benefits.

But what happens to these contributions once you’ve finished working in Germany? Is it possible to get them back?

The rules for getting a refund on your pension contributions from the German Pension Insurance are laid out in the German Social Security Code (§210 SGB VI) and further clarified in the Social Security Agreement between Germany and India. This agreement specifically caters to your circumstances as an Indian citizen, outlining the conditions under which you can apply for a refund and the steps to take to recover your contributions.

As you think about your future after working in Germany, being informed about how to claim a refund for your German pension contributions is crucial. As an Indian citizen, you might qualify for a refund if you meet certain criteria.

General Criteria for Pension Refund Eligibility:

Upon departing from Germany, you typically qualify for a refund of your German pension contributions if:

a) you are not permitted to make voluntary German pension contributions (voluntary insurance/ freiwillige Versicherung) from your current place of residence

and

b) a minimum of 24 months have elapsed since your last payment into Germany’s statutory pension scheme.

The possibility of making voluntary insurance payments (a) hinges on the social security agreement between Germany and your home country.

You are generally not entitled to a German Pension Refund if:

a) You are eligible for pension benefits or are already receiving a retirement pension from Germany.

b) You continue to make statutory pension contributions or are subject to mandatory insurance in Germany

c) You have the option to make voluntary contributions to the German pension system (freiwillige Versicherung).

Rule of thumb for the eligibility for German pension refund for citizens of India:

As an Indian citizen, you can only get a German pension refund if you have worked in Germany for less than 5 years (i.e. you have paid German pension contributions for a maximum of 59 months) and 24 months have passed since your last pension contribution in Germany.

Bilateral Social Security Agreements and their Implications

The bilateral agreements between Germany and India govern the exchange of social security benefits for citizens of both countries.

In essence, the agreement outlines that as an Indian citizen residing in Germany as a tax resident, you qualify for a German retirement pension after contributing for 60 months.

When it comes to making voluntary contributions to the Deutsche Rentenversicherung, the Social Security Agreement clarifies that if you are living in the EU or the UK, you have the option to continue contributing to be eligible for a statutory pension in Germany.

Moreover, should you have already contributed for a minimum of 60 months, you are permitted to make further German pension contributions from any location globally.

This implies that if you are residing within the EU/UK or have made contributions to the German pension system for at least 60 months, you are ineligible for a pension refund. This is due to your qualification for a German pension, with the agreement allowing you, as an Indian national, to make voluntary contributions regardless of whether you benefit from them directly.

If you haven’t met the requirements for a pension and reside outside the EU or UK, you could qualify for a pension refund 24 months following your most recent contribution.

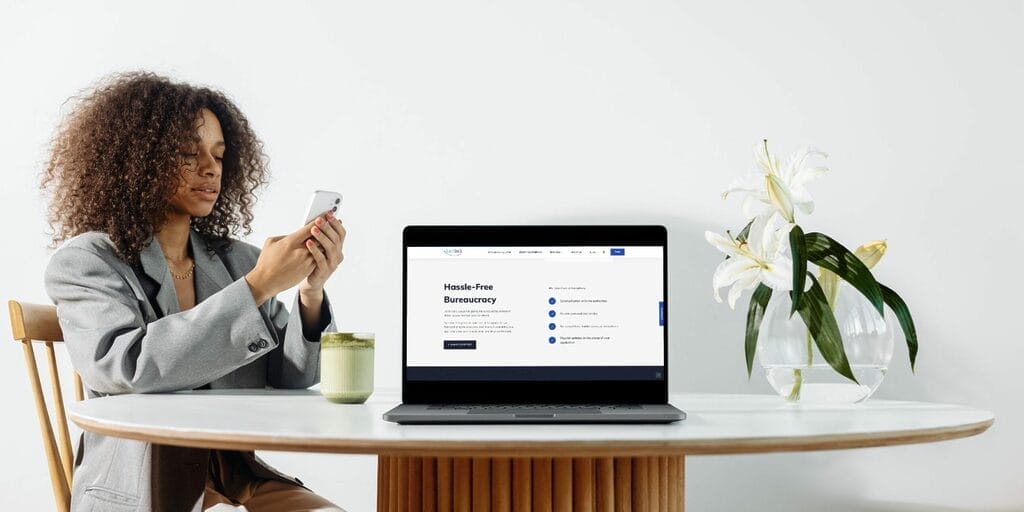

Start to claim your Pension Payout with our Free Eligibility Check

When dealing with German pension refunds, it’s crucial to understand that the typical processing time can vary widely, often stretching from a few months to more than half a year. However, for individuals looking for a quicker resolution, specialized services like Fundsback offer an expedited process. At Fundsback, we’re recognized for our rapid and effective service, dedicating ourselves to optimizing your pension refund with professional advice.

Furthermore, Fundsback provides essential resources including a free eligibility check and a handy refund calculator. These tools enable you to effortlessly assess your eligibility and calculate potential refund amounts. Our goal with the refund calculator is to offer a transparent and straightforward method for you to review your pension insurance history with the German pension fund and pursue a pension refund.

Enhance Your German Social Security Benefits: Simplifying Pension Refunds with Fundsback

Fundsback simplifies the process of enhancing your Social Security benefits in Germany, making it an efficient and easy journey. Our experts at Fundsback offer specialized support and advice to Indian citizens looking to understand and apply for German pension refunds. Given the complexity of cross-national agreements, social security frameworks, and pension systems, professional help can be invaluable in ensuring you are well-informed and stress-free during the entire process.

Fundsback excels in providing tailored guidance to evaluate your eligibility for a refund and ensure you receive the maximum payout from your German pension refund.

Choosing to work with Fundsback allows you to effortlessly manage the complexities of German pensions and secure your refund with confidence, sparing you from the burdens often associated with these processes.

Do you need help with your German pension? Contact us today for a consultation!